By the

This is some text inside of a div block.

This is some text inside of a div block.

•

5

min read

As we enter the midpoint of 2025, the cryptocurrency market is showing signs of renewed momentum, underpinned by institutional adoption, macroeconomic catalysts, and long-term post-halving effects. For investors, traders, and crypto-curious observers alike, understanding what’s driving the market today can shape better decisions tomorrow.

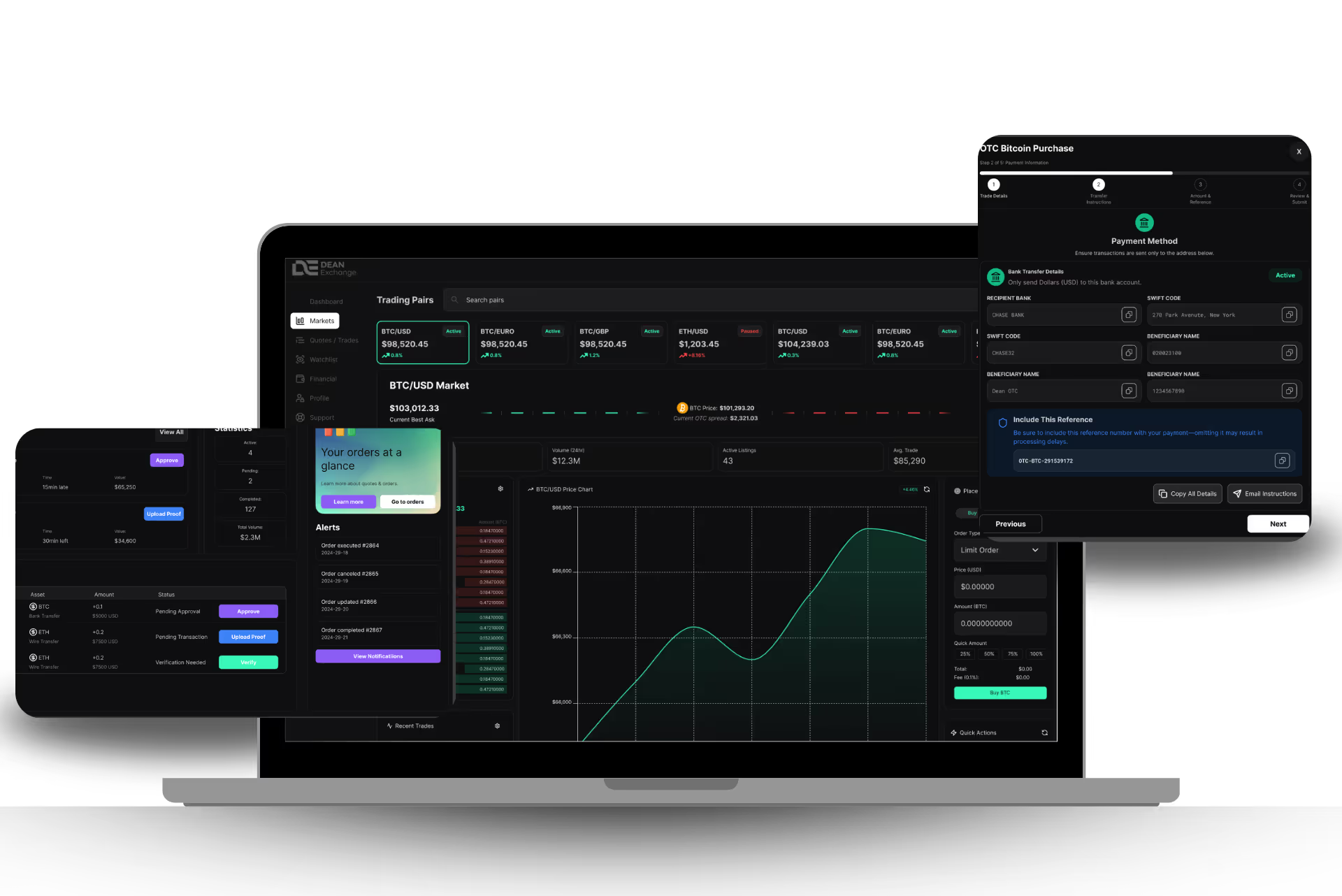

In this article, we analyze the recent Bitcoin to USD exchange movement, highlight the best altcoins to invest in this month, explore macroeconomic influences like ETF inflows and institutional interest, and unpack how the post-halving cycle is reshaping market sentiment. With guidance from trusted resources like Dean Exchange, you’ll be equipped with the insight needed to navigate these trends confidently.

Bitcoin (BTC) continues to command its role as the market leader. Over the past month, the Bitcoin to USD exchange rate has climbed steadily, flirting with multi-month highs. Several forces are behind this movement:

The rollout of U.S.-regulated spot Bitcoin ETFs has brought massive inflows from institutional investors, effectively removing friction from Bitcoin exposure for pension funds, hedge funds, and asset managers. In the first quarter of 2025 alone, ETFs accounted for over $12 billion in BTC inflows, tightening supply on exchanges and adding price stability.

Unlike retail investors, institutions play a long game. Many are now viewing Bitcoin as a macro hedge against inflation and a portfolio diversifier. As on-chain data shows, wallets holding over 1,000 BTC—often categorized as whales or institutional wallets—are accumulating again, a bullish indicator for long-term growth.

With central banks signaling interest rate cuts amid global economic cooling, risk-on assets like crypto are rebounding. Bitcoin is increasingly seen as a resilient asset in uncertain macro environments, gaining popularity across both emerging and developed markets.

While Bitcoin anchors the market, altcoins often deliver outsized returns during bullish phases. Let’s look at this month’s best altcoins to invest in based on price performance, utility growth, and investor sentiment.

Solana continues its strong rebound, driven by explosive activity in decentralized finance (DeFi) and non-fungible tokens (NFTs). With gas fees consistently low and a thriving developer community, Solana has emerged as a viable alternative to Ethereum.

Notable catalysts:

Chainlink is the backbone of blockchain data—its decentralized oracles connect smart contracts to real-world data. With the expansion of Chainlink Functions and CCIP (Cross-Chain Interoperability Protocol), LINK has become integral to blockchain interoperability.

Why it’s surging:

As one of Ethereum’s leading Layer 2 networks, Arbitrum is seeing significant developer traction and liquidity migration. Transaction volumes and active wallet counts are both trending upward, suggesting growing user trust in Layer 2 scaling solutions.

What’s driving growth:

In the intersection of crypto and AI, Render provides decentralized GPU compute power. As AI use cases explode in demand, RNDR is uniquely positioned to serve real-time rendering and model training infrastructure.

The Bitcoin halving in April 2024 reduced miner block rewards from 6.25 to 3.125 BTC. This structural shift has long-term implications for market supply and investor behavior.

With fewer new BTC entering circulation daily, supply becomes more limited. Combined with ETF demand and long-term holder accumulation, this scarcity narrative adds bullish pressure.

Key indicators supporting the current trend:

These post-halving dynamics are historically associated with the early stages of bull markets.

Beyond crypto-native events, broader macro trends are also shaping 2025’s crypto market trends.

Central banks around the world are pivoting toward monetary easing after years of aggressive tightening. As real yields decline, capital is flowing back into risk assets, including digital assets.

A weakening U.S. dollar is fueling international interest in cryptocurrencies as an alternative store of value. This dynamic particularly benefits Bitcoin, but it’s also contributing to rising altcoin demand in emerging markets.

The growing integration of blockchain with AI, IoT, and Web3 applications is bringing new capital and talent into the crypto space. As legacy enterprises begin blockchain trials and pilot programs, confidence in the long-term viability of crypto technology continues to grow.

With crypto markets moving quickly and often unpredictably, staying informed is your edge. Dean Exchange is committed to making crypto education accessible, practical, and expert-driven.

Whether you're building your portfolio, preparing for your first trade, or diving into on-chain analytics, Dean Exchange offers the tools and tutorials to help you make confident decisions.

If you’re navigating the current market, here are some strategies worth considering:

Look at data from sources like Glassnode and CoinShares to understand which assets institutions are accumulating.

Projects like Arbitrum and Optimism are becoming central to Ethereum’s scaling narrative and may offer early-mover opportunities.

While BTC is foundational, altcoins like Solana, Chainlink, and Render offer growth potential based on real-world utility.

Don't trade blindly. Use cryptocurrency tutorials and market recaps from platforms like Dean Exchange to build a foundation in blockchain literacy.

The convergence of institutional adoption, post-halving scarcity, and macroeconomic tailwinds is creating a fertile environment for digital asset growth. Bitcoin continues to set the tone, but altcoins are thriving in their own right, backed by real technological advances and ecosystem expansion.

Understanding these crypto market trends isn't just about watching prices—it's about grasping the underlying shifts in capital, sentiment, and technology. With tools, tutorials, and live sessions, Dean Exchange is here to ensure that your journey through crypto is informed, strategic, and successful.

Join our newsletter for exclusive insights, breaking crypto trends, and learning opportunities—delivered straight to your inbox.